What is Leverage?

Leverage is when a trader has the ability to use a small capital to execute a large volume of trades in the forex market. Leverage is the ratio of the trade size compared to the capital invested. For example, a leverage of ratio 50:1 means $200 of equity is required to trade an order that is worth $10,000. A leverage of ratio 100:1 implies that $2,000 of equity can trade an order that is worth $200,000 while a leverage of ratio 500:1 means $1,000 of equity can trade an order that is worth $500,000.

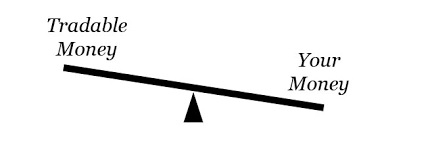

Leverage can be summarized as a loan or borrowed funds from Forex Brokers.

Caution: Forex trading is risky. It is advisable that you acquire enough experience before you start to trade with real money. Do not invest in money that you cannot afford to lose (it is important that you study leverage, lot size, and money management in Forex trading very well before you execute your trade decision).

To trade in the Forex Market you must first sign up with a Forex Broker. There are lots of Forex Brokers out there that offer good service to their clients. Services include tight spread, partnership amongst others. My preferred brokers are 1. Alpari (https://alpari.com/en/?partner_id=1244646) and 2. FXTM (http://forextime.com/?partner_id=4806145). You may sign up through any of the partner links above. You may also send me a mail in case you need me to guide you on how to sign up and start trading (beanfxtrader@gmail.com).

Referral links;

(Forex Broker: Exness … https://one.exnesstrack.org/a/3tfpd2bc9i)

(Email: beanfxtrader@gmail.com)

(Telegram: https://t.me/joinchat/AAAAAE97zaWdZg5KBbrIVQ)